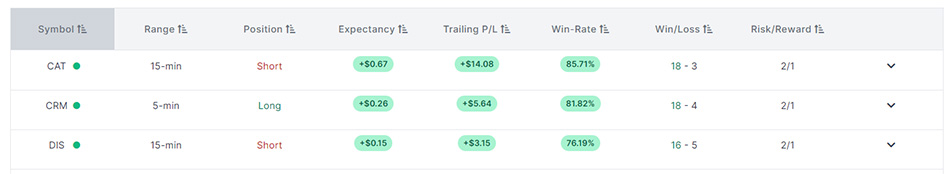

Live Scanner Table

The Live Scanner Table is an important tool that allows traders to monitor a variety of key metrics related to their trades in real-time. The table is organized into rows that contain information about each individual trade.

- Symbol This column lists the symbol which has triggered an opening range breakout.

- Range This column shows the range of the opening breakout for the security. Smaller range widths compared to usual generally tend to expand as the day goes on.

- Position This column tells you whether the trade is a long or a short breakout. The backtest performance stats displayed in the next 4 columns automatically use this as a filter. For example, if a long setup is triggering, then it will only display the long setup’s backtest in the columns, instead of the total strategy performance (which includes short setups).

- Expectancy This column shows the 90-day trade expectancy of this strategy for the long or short setup.

- Trailing P/L This column displays the 90-day trailing profit or loss for the trade up to the current point in time, for the long or short setup.

- Win-Rate This column displays the 90-day win-rate for the particular symbol and long or short setup.

- Win-Loss This column tells you how many trades were winners vs. losers for that particular long or short setup. The first number is the number of winners, the second number is the number of losers.

- Risk/Reward This column shows the potential risk versus reward ratio for the trade. The first number is the risk, and the second number is the reward. For example, 1/2 implies you are risking 1 to make 2.

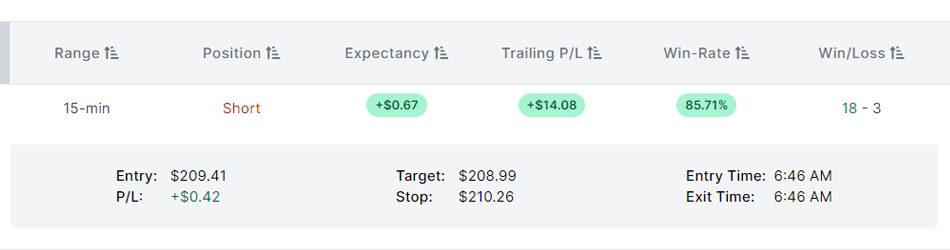

Collapsible Trade Rows

Each row in the Live Scanner Table is also collapsible. If you expand it, you will see a detailed view of the trade. This detailed view includes:

- Entry Price

- Target Price

- Stop Price

- Entry Time

- Exit Time (if trade is closed)

- P/L for this trade only

Pro Tip:

You can use the P/L value to find places where the P/L is negative while the trade is open. This means that you can easily find the symbols with better entry prices than breakout levels, while still having strong backtests.

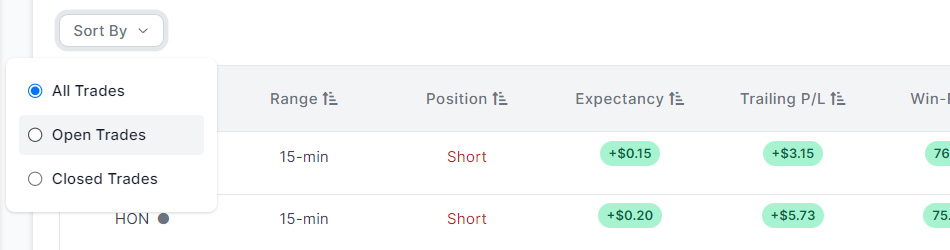

Sorting Trades Quickly

You can sort the table by open trades only, closed trades only, or all trades. Sorting by open trades only is useful during market hours to find trades that are still active. Sorting by closed trades only is useful for studying each day’s opening range breakouts and learning from them. Sorting by both is an option if you’d like to see all trades.

By using the Live Scanner Table, traders can easily monitor their trades, identify patterns, and make informed decisions in real-time.