Once your backtest is complete, you will see a detailed report of your trading strategy’s performance. The report is divided into different sections, each providing relevant metrics and insights into your strategy’s strengths and weaknesses.

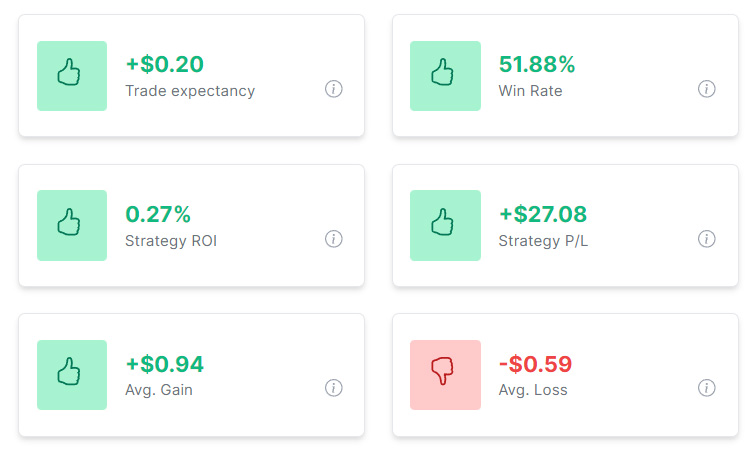

High-Level Overview:

The top section of the strategy report provides a high-level overview of the entire strategy. Users can view various statistics related to their strategy’s performance, along with a P/L over time bar graph.

The following stats are included in this section:

- Trade expectancy This statistic represents the expected outcome of a trade based on historical data, calculated by dividing the total P/L by the total number of trades. If the trade expectancy is greater than 0, then you will see a green thumbs up icon, representing the positive trade expectancy.

- Win rate This statistic represents the probability of success for this particular strategy, and is calculated by taking the number of winners and dividing that by the total number of trades. If the win rate is greater than 50%, then you will see a green thumbs up icon, representing the positive win rate.

- Strategy ROI This statistic represents the total return on investment of this strategy, using stocks as the asset vehicle. This is calculated by taking the total strategy P/L and dividing it by the total amount invested, using a 1-share basis (assumes commission-free trading for equities). If the strategy ROI is greater than 0, then you will also see a green thumbs up icon, representing the positive strategy ROI.

- Strategy P/L This statistic represents the total profit or loss of this strategy over the backtest length. If the strategy P/L is greater than 0, then you will also see a green thumbs up icon, representing the positive strategy P/L.

- Average Gain This statistic represents the average profit made on each winning trade. There will always be a green thumbs up next to the average gain statistic.

- Average Loss This statistic represents the average loss incurred on each losing trade. There will always be a red thumbs down next to the average loss statistic.

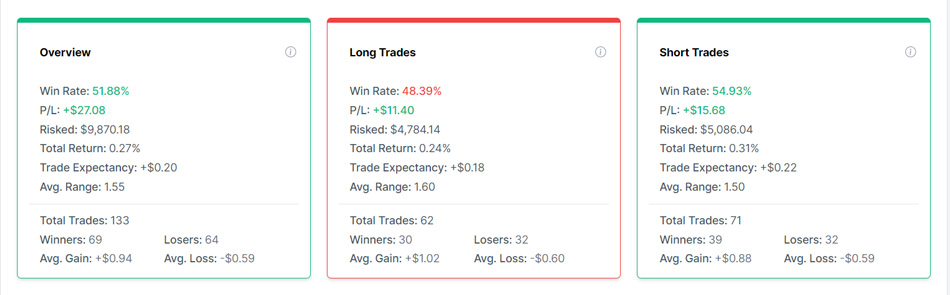

You can also view a breakdown of long vs. short trades only, to analyze respective performance of the strategy for one direction only.

P/L Over Time Graph:

The P/L bar graph plots how the P/L has changed over time. With that information, you can better understand how the strategy has fared over time. This is particularly useful in gauging max drawdown over the duration of the backtest, and check to see how the equity curve has varied.

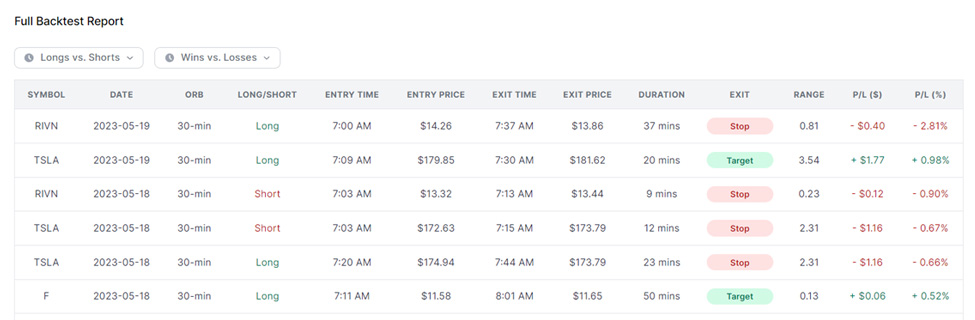

Full Backtest Report:

At the bottom of the strategy report, you can view the full backtest report, which contains a table with all the trades that have triggered during the backtest period.

You can filter by longs vs. shorts and wins vs. losses if you only want to apply specific filters.

The following columns are included in the table:

- Symbol: This column represents the symbol for the traded security.

- Date: This column represents the date on which the trade was executed.

- ORB: This column represents the ORB range for the trade.

- Long/Short: This column represents whether the trade was long or short.

- Entry Time: This column represents the time at which the trade was entered.

- Entry Price: This column represents the price at which the trade was entered.

- Exit Time: This column represents the time at which the trade was exited.

- Exit Price: This column represents the price at which the trade was exited.

- Duration: This column represents the duration of the trade in minutes.

- Range: This column represents the width of the opening range.

- P/L ($): This column represents the profit or loss in dollars for the trade.

- P/L (%): This column represents the profit or loss as a percentage of the initial investment.