What is the Opening Range Breakout Strategy?

The Opening Range Breakout (ORB) is a trading strategy commonly used by traders to capitalize on price movements that occur during the opening period of a trading session. The term Opening Range refers to the price range established within a specific time frame, usually at the beginning of the trading day. The three most common opening ranges are the first 5, 15 and 30 minutes of trading activity every day.

The strategy is based on identifying the high and low prices in any of those time periods, and then taking a position in the direction of the breakout when the price breaks out of that respective range. The idea behind this type of a breakout setup is to identify and take advantage of early momentum that is likely to be sustained for the rest of the trading day.

The benefits of ORB trading include:

- Early Entry By focusing on the opening range, traders can enter positions at an early stage of a potential price breakout, allowing them to capture the initial momentum and potentially generate higher returns.

- Defined Risk and Reward ORB trading enables traders to set clear stop-loss orders and profit targets based on the width of the opening range. This helps manage risk effectively and maintain a favorable risk-to-reward ratio.

- Objective Approach ORB trading relies on technical analysis and price action, making it a relatively objective strategy. Traders can establish specific criteria for breakouts and use them consistently across different market conditions.

- Scalability The ORB strategy can be applied to various timeframes and markets, making it suitable for traders with different preferences and trading styles. It can be employed in stocks, futures, forex, and other financial instruments.

- Enhances Discipline: ORB trading requires traders to follow a structured approach and adhere to predetermined entry and exit rules. This promotes discipline and reduces the impact of emotional decision-making in trading.

The ORB strategy provides traders with a systematic method to identify breakout setups and take advantage of early momentum.

Opening Range Breakout Trade Example

Let’s take a look at the same example from above, inside of the S&P 500.

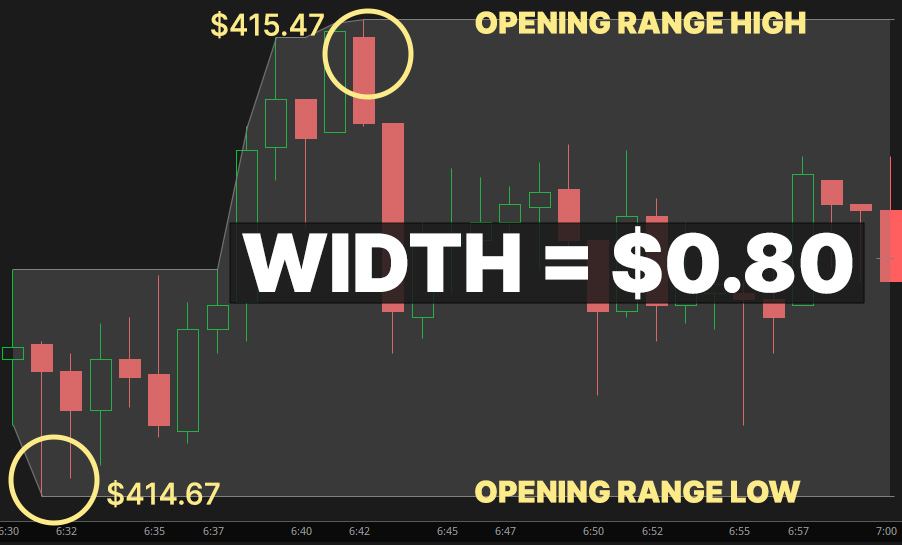

Using the first 30-minutes as our opening range, the opening range high is $415.47. The opening range low is $414.67, which formed a minute after the market opened.

That gives us a width of $0.80 ($415.47 – $414.67).

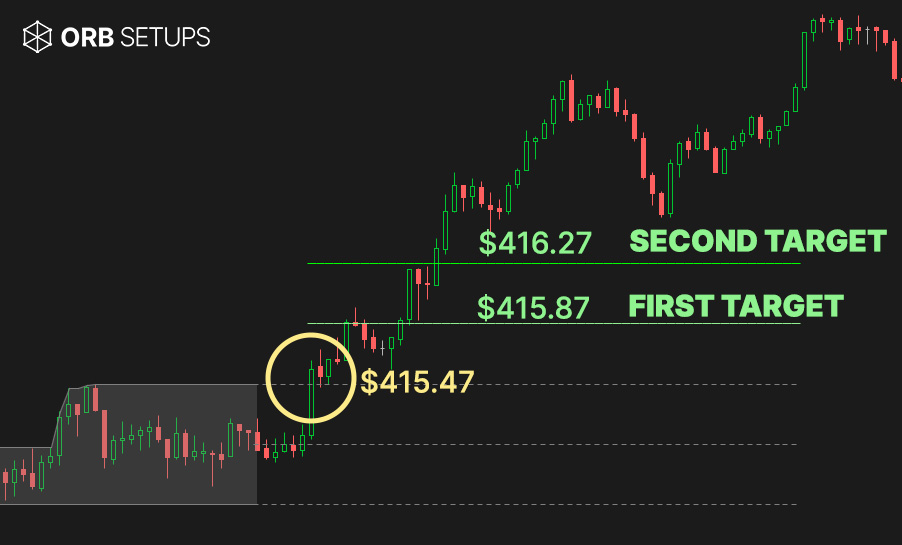

Now, we wait for a breakout of either the opening range high or opening range low levels.

The breakout occurs 6 minutes after the end of the opening range period, and the S&P 500 goes on to hit not only the first and second targets, but exceeds well past that. This is an example of a small opening range expanding as the day progresses. The 30-minute opening range breakout is discovered by our Live Scanner on the breakout candle (7:06 AM PT), and the 3-month ORB performance is easily accessible on the scanner.