Identifying false breakouts is an essential part of an Opening Range Breakout trader’s skillset. It can help avoid losses, and more importantly, help minimize the mental fatigue caused by losses.

Here are some tips for identifying and dealing with false breakouts:

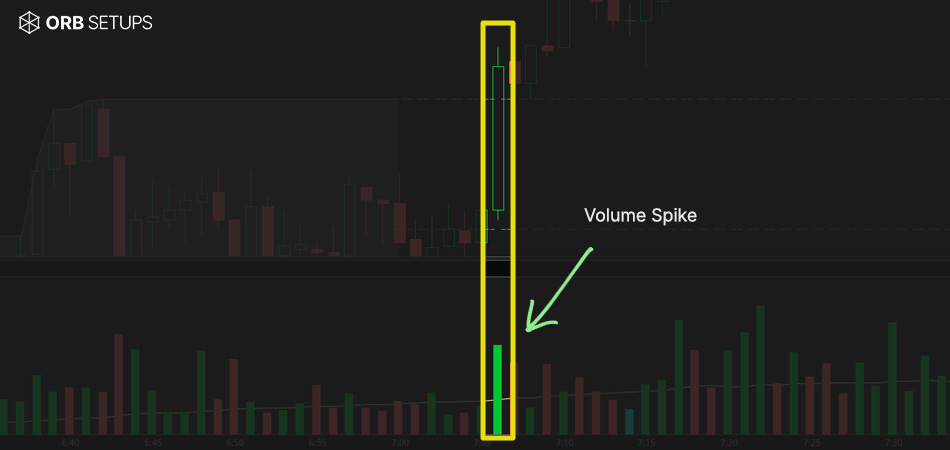

- Confirm the breakout with volume Volume is often a helpful confirmation signal when a breakout is triggering. It supports the idea that the breakout has legs underneath it, and is likely to sustain a move to at least the half-range target level. Volume can be confirmed manually in your brokerage’s charting platform.

- Watch for a retest of the breakout level Sometimes, a stock will break out of a range, only to quickly retest the breakout level. If the price fails to hold above the breakout level on the retest, it may be a false breakout.

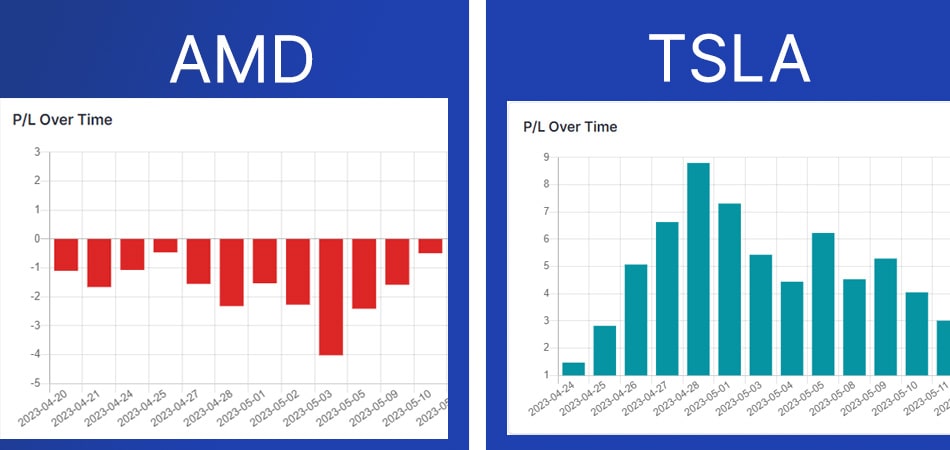

- Build a “Cheat Sheet” for Your Favorite Markets Use the built-in ORB backtester to test your favorite markets. It takes just a few seconds every week, but the backtest helps you build out a scorecard to know which markets the ORB strategy is currently performing well within. You can also use the Live Scanner to automatically do this job for you, if you feed in a custom watchlist.

- Be aware of scheduled catalysts News events can have a significant impact on a stock’s price, and can often cause false breakouts. For example, if many stocks break out when an economic news report comes out (ie. CPI), and the broader market has one of its infamous sharp reversals, chances are the breakout stocks will follow. A good way to get a list of all news events for the day is by using a site like Forex Factory, and focus on the red-folder events for critical events. A good way to get a list of earnings reports for the day is by using a site like Earnings Whispers and being aware of earnings volatility.

By following these tips, traders can better identify false breakouts and avoid costly losses. Remember, using the backtester to gain a better understanding of market personality can be a powerful tool in identifying potential false breakouts.